On Wednesday, November 18, 2011, Mr. John Tomlinson spoke to The Nassau Institute.

The speech updated and expanded his presentation of May 18, 2011 which was held in The Milton Friedman Room at the offices of The Nassau Institute on East Bay Street. Watch the video of the May 18 presentation by clicking here…

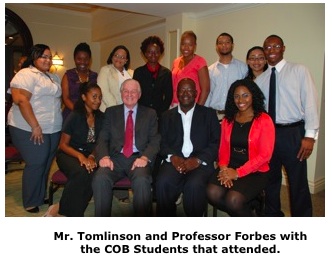

The evening was also attended by some of the economics students and Professor Randy Forbes form the College of The Bahamas.

You can read the entire text of Mr. Tomlinson’s speech below, or download the file in Portable Document Format (PDF) here… TomlinsonNov162011.pdf

A video of the second half of his speech, on how to protect the Free Market, will be presented once the editing is complete.

WHY ONLY BETTER IN THE BAHAMAS?

WHY NOT BEST IN THE BAHAMAS?

I last spoke to the Nassau Institute in your committee room in May and discussed “How to protect the Bahamian banking system from the next world banking collapse and make it safer for future generations”, you kindly asked me if I would repeat much of it to a larger audience in a much bigger venue. Well, here we are. I hope what I have to offer lives up to your expectations.

‘It’s better in the Bahamas’ is a good slogan. I would like to suggest we can make it ‘BEST in the Bahamas’!

We can make it the best and set an example to the rest of the world. We can make the Bahamian banking system safe from the coming world banking collapse and safe and sustainable for our citizens for centuries to come. That’s my first objective.

Accomplishing it is a three-step process:

· First, we must remove all risk and moral hazard from our banking system. That will make it the safest in the world.

Today I will discuss how to remove that risk and moral hazard from our banking system.

· Second, I intend to show how those changes will also provide the opportunity for Bahamian banks to provide equity investments to businesses. This will then substantially reduce the current burden of debts and, in their place, build a collection of assets for future generations of Bahamians.

Unencumbered assets are central to a sustainable economy.

· Third, the subject I promised to return to in my last talk, the responsibilities we must each accept if we wish to ensure that an open and free market is developed and maintained here in the Bahamas.

When I say a free market, I mean a marketplace where everyone is able to make choices and provide for their families and those who are incapable are provided for.

Why do we need to do this?

· Sovereign debt is now at levels unprecedented, and growing because governments are unable or unwilling to deal with levels of expenditure,

· Taxpayers are beginning to revolt.

· All sovereign debt is now suspect.

· The recession which has gripped the Western world these last few years is not part of another economic cycle. Rather, we are living through the final stages – the death throws, as it were – of the paper money system as we know it. The last time world economies were in this position – in the 1930’s – we were on a gold standard and could revalue. We are not on a gold standard anymore. Another Bretton Woods is not possible.

· Gold is at or near an all-time high.

· Highly destructive natural disasters appear to be on the increase.

· The gross inequalities in income and living standards are breeding civil unrest in a world which today, for a number of reasons, is bereft of any moral or ethical compass.

Each one of the above is a threat to the Bahamas and our way of life. We have already had one massive collapse in 2007/2008. There have been no changes in the banking system since then to prevent further collapse. Worse, the state of debt in the world has increased significantly.

Who knows what event is going to trigger the next global banking collapse? No one, but we can be sure that something will trigger it.

When it does, we can also be confident that most banks – operating as they continue to do – will, once more, be found to be wanting. They are still holding massive levels of sovereign debt. Massive levels of toxic mortgages still remain on many of their books. Sovereign debt has become suspect and banks themselves are becoming suspect.

America is currently experiencing a new avalanche of foreclosures. In Europe, Greece approaches another bail-out, Portugal is receiving one and Ireland, Spain and Italy are on serious ‘watch’. The European Central Bank is stretched to the limit. The level of European debt is raising the spectre of collapse of the Euro.

In fact, the world is awash with debt: sovereign debt, corporate debt and personal debt are each at record and no longer manageable levels.

These are all reasons to be seriously concerned about the state of the world monetary and banking system.

No banking system is currently risk free; not the British, not the Canadian, not even our own Bahamian banking system.

Although the Bahamian and the Canadian banks managed to survive the downturn of 2007/2008 reasonably well, so long as they remain as they are currently structured, they, too, are subject to failure.

Yet, there is a world-wide reluctance to change the system. There is too much power and profit to be made as it is.

So, we can be confident that another Lehman moment is coming even though we cannot say precisely when or where it will be.

If we wish to protect the Bahamas from the coming turbulence, we must change the Bahamian banking system ourselves. We must free it from risk. We can free it from risk. We must free it from moral hazard. We can free it from moral hazard. No-one else is going to do it. We can and must do it ourselves.

We must do it now because we don’t know precisely when the next international banking collapse will occur. We can only know that when it does occur it will be massively larger and more severe than that of 2007/2008.

Before we begin to plan what to do, let’s look at money, how it came into being, the origins of banks and how and why they became vulnerable.

Originally we exchanged through simple barter. Barter didn’t work for every exchange and the need soon arose for a commonly accepted medium of exchange. No medium of exchange could be acceptable if either party to the exchange believed it was not accurate or fair. Accuracy of the measurement of exchange value of any medium of exchange was – and remains – the key to fair exchanges.

Many products were tried. Some deteriorated over time and their exchange value diminished. Tomatoes, for instance, deteriorated over time. They rot. As they deteriorate their value is reduced. They are not acceptable as a useful store of value.

Nor are grains of sand. Grains of sand might not deteriorate overtime but they are so easy to obtain in large quantities that each grain has little exchange value and a large amount would be needed for even the most minor of exchanges. They too are impractical.

Many commodities were tried. Eventually gold became accepted throughout the world as the most accurate, stable and useful product or commodity to use as a medium of exchange.

Why gold?

1. It did not deteriorate over time.

2. It is homogeneous. Therefore, it can easily be divided into smaller portions of equal purity and used for exchanges of smaller exchange value.

3. It is scarce. Therefore it takes a great deal of human energy to find and refine.

In most matters gold has the attributes of a successful medium of exchange. That is why gold lasted for centuries as the most trusted and most accurate “money”………AND THAT IS WHY PEOPLE ARE RETURNING TO IT ONCE AGAIN AS THEY LOSE FAITH IN PAPER MONEY.

(We must always remember that every increase in the price of gold signals a recognition of a similar loss of purchasing power in paper money – in particular the U.S. Loss of purchasing power means more is required in an exchange or prices go up. That is inflation.)

In the early days how did you protect your gold coins from thieves? If you had one, you could carry it with you and sleep with it and protect it. Ten might get a bit lumpy! One hundred could become downright uncomfortable.

Even for one hundred gold coins, it might not be practical to build a strong room or a strong box. So, people looked for a way to store their gold coins safely.

Goldsmiths had sufficient stocks of gold to afford to build a strong room. They stored their gold on shelves in their strong rooms. Some of them had extra space on their shelves. Some people began to rent space on the shelf of the strong room at one of their local goldsmiths. The goldsmith would charge them a storage fee.

The goldsmith would give them a receipt for the amount of gold they stored. He would also give them a form upon which that he would accept instructions to deliver the gold, or part of it, to someone else. Today, we call that form a cheque.

In accepting the gold for storage, the goldsmith would accept a fiduciary responsibility to safely store the gold deposited with them. Those who stored their gold on the shelves of their goldsmith found it very convenient and believed their gold to be secure. The practice grew.

A shelf in those days was known as a ‘bank’. The goldsmiths soon became known as ‘bankers’ and their businesses as ‘banks’.

As their businesses grew and more and more people stored their coins with banks and bank shelves became fuller and fuller, bankers soon noticed that only the first few rows of coins moved.

When people brought new coins for storage and others withdrew their coins, coins came and went from these first few rows but the coins at the back remained on the shelves and did not move.

Soon some bankers began to take some of the gold coins which sat at the back and used them to earn themselves income in the form of ‘usury’ or ‘interest ’as we call it today. They reasoned that no-one would be the wiser and that they wouldn’t get caught because they could return the removed coins before the people to whom they belonged might notice they were missing or claim them back.

The bankers who did this knew full well that what they were doing was wrong, fraudulent and illegal. They also knew that, if this treachery were to be discovered, they would no longer be trusted to store other people’s gold.

Therefore these early bankers developed the practice of always behaving impeccably. They adopted a circumspect and extremely prudent manner. They needed to behave this way to maintain confidence in their banks – not much different than Bernie Madoff recently.

Of course, the only reason it became necessary to maintain confidence in their bank was that, if anyone looked too closely, the bankers had fraudulently misrepresented the amount of gold they had on their shelves and for which they had issued receipts.

There was absolutely no reason whatsoever for anyone to be confident. Instead, to remain in business, bankers had to sell the idea of confidence to the public so that no-one looked too closely.

Why do you say ‘fraud’? Why do you say ‘misrepresentation’? You may well ask. How can ordinary, everyday banking be fraudulent? Let’s examine the case a bit more.

The borrower of gold coin held on deposit would have bought something with it and the seller of whatever was bought would have received the borrowed gold coin in exchange.

The seller would then have lodged this “borrowed” gold coin with the bank for safekeeping. The bank would then have issued a receipt for the “borrowed” gold coin.

But, the original depositor would still have his receipt for the same gold coin.

Thus, the banker would have issued two receipts against the same gold coin! And when the bank loaned the re-deposited coin, upon deposit by a further recipient, a third receipt will be issued and further misrepresentation will occur. Etc., etc., etc!

Issuing two receipts for the same coin is nothing less than a misrepresentation and a clear fraud. Issuing three is an even greater fraud!

The misrepresentation would still exist even if the seller had deposited the borrowed gold coin into different bank. Under those circumstances the banking system as a whole would have issued two receipts for the same gold coin and the banking system as a whole would have misrepresented the number of gold coins held within it. In that case, the banking system as a whole would have been, perhaps unwittingly, participating in the fraud.

HERE WAS THE BEGINNING OF LOSS IN VALUE OF PAPER MONEY. IF ALL RECEIPTS HAD BEEN PRESENTED AT ONCE, ALL RECEIPTS COULD NOT CLAIM THE AMOUNT OF GOLD THAT EACH SAID IT COULD ON ITS FACE. THERE WOULDN’T BE ENOUGH GOLD IN THE SYSTEM.

As the volume of deposits increased, bankers began to print and issue standard receipts. They would pre-print a number of receipts, each for one, two, or three gold coins payable to the bearer. When one or more gold coins was deposited, bankers would give the depositor one or more of these pre-printed receipts totaling the precise number of gold coins deposited.

In the belief that each of these pre-printed receipts was fully backed and freely exchangeable for the amount of gold printed on its face, some people began to trade these receipts in lieu of gold. This was the beginning of paper money.

Banks soon began to lend their paper receipts as well as gold coins and when the recipient deposited the paper receipts in the bank, the bank would issue the depositor with a receipt for this paper money. Thus, banks would have issued another receipt against the original gold coin deposited. The fraud became larger. When banks also began to lend their paper receipts, the rate of fraud accelerated. Today there are few limits to the amount of misrepresentation that is permitted.

From the day the first banker took the first of his depositors’ gold coins and used it for himself, it became impossible to reconcile the total of all receipts issued with the actual amount of gold available to honour them. The gold-backed monetary system was finally destroyed by this impossibility.

This destruction happened in stages, beginning with a series of re-valuations over the centuries. These re-valuations purported to be re-valuations of gold. They were nothing of the sort. They were re-valuations of the receipts, continually reducing the amount of gold each piece of paper money actually represented as the number of receipts issued against each gold coin grew. The series of formal revaluations ended in 1944 with the Bretton Woods Agreement which reduced the amount of gold in each U.S. Dollar to 1/35th of an ounce. Every other currency was then measured in terms of U. S. Dollars.

The gold-backed monetary system finally ended in 1971 when President Nixon had to close the ‘gold window’ because he could not convert all of the dollars tendered by foreign governments for gold under the terms of the Bretton Woods agreement. There simply wasn’t enough gold in Fort Knox.

The French had sent a battleship to New York, with all of their US dollars on board, to exchange them for gold.

President Nixon knew there was not enough gold in Fort Knox. Battleship or no battleship, President Nixon had no choice but to stop the exchanges. He is pilloried by many economists and financial commentators today for not honouring the exchange requirements of Bretton Woods. Those who do so are uninformed of the facts. Nixon had no choice. Most of the gold didn’t exist.

This default became known as the ‘closure of the gold window’. Following this closure, the amount of gold for which each dollar was guaranteed by the U. S. Government to be freely exchangeable finally reached zero. Each other paper currency had previously been guaranteed exchangeable for gold by the issuing governments at the dollar rate. So, none were now guaranteed to be exchangeable for gold at a specific rate and the guaranteed exchange value of all paper money had diminished over the centuries from full backing by gold to zero.

Further revaluation is what is happening today. The price of gold is going up is what the market tells us. The other side of this statement is that the value of paper money is going down. It is important to have this picture clear in your head if you wish to understand what is really happening in the markets today when you see the price of gold at $1750 or more. The value of a U.S. Dollar is now 1/1750th of an ounce.

The value of paper money is being further reduced by the continued lending activities of the entire world banking system: commercial banks and central banks in particular.

A recent study which divided the amount of gold in Fort Knox by the number of dollars in existence today, arrived at a figure in excess of $10,000 per ounce. So, since Bretton Woods – only 67 years ago – the dollar has shrunk from 1/35th of an ounce to 1/10,000th of an ounce.

Under the gold standard there was no measurable increase in the cost of living in Britain, Switzerland, France or the US from 1750 to 1914 – a period of 164 years. Which would you rather have?

Yet, at each stage in the process of destroying paper money, it was gold that has been – and still is – blamed by the bankers for being too restrictive on their ability to lend. Uninformed people still point their finger at gold and blame it for many of today’s economic difficulties.

Hopefully, having now reviewed the process in detail, we can see more clearly that the reality is: banks had been too busy producing fraudulent receipts purporting to represent more gold than the banks or even Fort Knox actually held. In other words, the culprit is increasing the money supply without increasing the value behind it. That is ordinary bank lending.

Two judicial decisions in the UK, the first by Sir William Grant in Carr vs. Carr [1811] and the second by Lord Cottenham in Foley vs. Hill [1848], legitimized the banks’ practice of issuing fraudulent receipts by determining that the instant a depositor puts money into a cheque account, title to that money transfers from the depositor to the bank.

SINCE THOSE DATES THE MONEY HELD ON DEPOSIT HAS NOT BELONGED TO DEPOSITORS. THE BANKS THEMSELVES HAVE LEGALLY OWNED ALL THE MONEY DEPOSITED IN THEM.

IT IS NOT YOUR MONEY ANY MORE. THE BANKS CAN DO WHAT THEY WANT WITH IT.

IF YOU THINK YOU HAVE MONEY IN THE BANK, YOU ARE WRONG. YOU HAVE BEEN REDUCED TO NO MORE THAN AN UNSECURED CREDITOR AND SECURED CREDITORS (mostly other banks) HAVE A FIRST CLAIM ON THE MONEY YOU THINK IS YOURS.

THE MONEY-LENDING OPERATION OF BANKS IS NOW PERFECTLY LEGAL. ACCORDING TO THE LAW, IT IS NO LONGER A FRAUD.

BUT, THE MECHANISM HAS NOT CHANGED AND THUS THE MONEY LENDING MECHANISM OF THE BANKING SYSTEM STILL PRODUCES THE SAME MISREPRESENTATION.

MISREPRESENTATION IS A FUNDAMENTAL PART OF THE ONWARD LENDING OF DEPOSITORS’ FUNDS.

HERE IS THE ROOT CAUSE OF BOTH RISK AND MORAL HAZARD IN THE BANKING SYSTEM. IT IS THIS ROOT WE MUST REMOVE TO MAKE BANKS COMPLETELY SAFE.

TO REMOVE THEM WE MUST REVERSE THOSE LEGAL JUDGEMENTS.

To summarize the banking system as it is now:

1. All of the money in the banks belongs to the banks – not to depositors.

That gives bankers enormous power. If you or your business needs money, banks can provide it – but, on their terms! If you don’t meet their criteria you have no access to it. Banks only lend money. They are the creators of most of the debt that exists in the world today.

One of their criteria is that you must already have sufficient other assets to repay any money borrowed easily, if necessary. Those without sufficient assets (the poor) are thus excluded from access to the bulk of the money-supply.

Lower on the bank’s list of criteria is the merit of the investment itself. Better ideas will not get financed if the promoters do not have sufficient other assets to ensure repayment.

2. Purchasing power is being removed from the poorest members of society.

Although not the only ones, the poor are excluded from the redistribution of purchasing power the banks make daily. To see the extent of this redistribution, look at the volume of bank-created money. In 1971, when President Nixon closed the gold window, the entire money supply of the UK was £31 billion Pounds Sterling. That means that, since the inception of the UK, through the building of the Commonwealth, through industrialization, through all the wars of the 19th century and the great wars of the twentieth century, over the centuries all the way up to 1971, the UK needed only £31 billion to fund it all.

Today the money supply in the UK is in excess of £1700 billion Pounds Sterling. In 40 years the moneylending practice of banks has created £1669 billion Pounds Sterling for their own use out of thin air, for their own benefit. The total money supply only 40 years ago is but 2% of the money supply now. The quality of life has not increased by 98% since 1971.

It follows that those with insufficient assets to meet the banks’ lending criteria, those on fixed incomes and those who have had no need to borrow have been excluded from access to newly created money representing 98% of today’s purchasing power. By the time the less fortunate receive this newly created money in exchange for their labour, it would already have been substantially reduced in purchasing power. Their quality of life will have been reduced. The cost of living has grown disproportionately and the gap between the rich and the poor has grown beyond acceptable limits.

Are you aware that at only 3% inflation pa, money loses more than 1/3 of its purchasing power every ten years? (Today, that is the level of inflation many economists and governments seem to believe is an acceptable level.) What does that do to your pension or those living on fixed income?

3. No banks hold enough ‘cash’ to meet all withdrawals simultaneously.

In 2007/2008 the Western banking and monetary system faced massive collapse. Why? For the same reason the gold system collapsed. Every time banks issue new loans, they create new money. Today money is a digital figure. Banks credit the borrower’s account with the amount of the loan. The total deposits increase and the money supply increases. But, the amount of ‘cash’ available to meet the now increased claims doesn’t increase. No bank holds enough cash to meet all withdrawals at the same time. When a ‘rush’ occurs, banks look to selling assets and to ‘lenders of last resort’ to provide the ‘cash’ to bail them out.

The quality of ‘collateral’ held as assets by many banks in the US today remains suspect. Many banks continue to hold ‘toxic’ assets in the form of foreclosed mortgages at their original loan value. They have not been required to re-price them at current market value, or ‘to mark to market’. They can afford to continue to hold them because the Federal Reserve lends them money at the rate of 0.0025 % whilst banks then lend it to the government at 3.5%. These two combined, have hidden the real state of too many American banks for too long. Those who do know – other banks – are reluctant to make any further loans on the interbank market and interbank lending is drying up.

4. The system of Central Banks as lenders of last resort has failed.

Banks used to depend upon Central Banks as lenders of last resort to bail them out in the event of a rush. In 2007/2008 the Central Banks alone couldn’t do it and the taxpayers had to bail them out.

Bankers have always lent to their point of imprudence in pursuit of maximum profit. This pursuit first destroyed the gold standard. Then it destroyed the Central Bank standard. Now all banks, central and commercial, are dependent upon taxpayers. But, taxpayers are in revolt. Will they continue to bail out banks? I think not. I hope not.

5. The world is awash with debt.

In September, this year the British Chancellor of the Exchequer, George Osborne stated it very clearly in his comments on the final report of the Independent Commission on Banking in the U.K.

“A decade long debt-fuelled boom that ended in a dramatic financial crisis, a deep recession and a debt overhang that is still holding back our economy.”

Yet, there is a hue and cry to ‘get banks to lend again’. Where’s the logic? We don’t need more debt. We already have a world-wide debt overhang that is holding back economic activity. The last thing we need is more debt.

What we need is more investment – investment in the form of equity, not debt. Equity investment can get the economy moving again without the burden of debt and the drag of interest payments or capital repayments. These payments take money out of a company limiting its ability to grow and employ more people.

Contrary to popular belief, banks do not provide capital. They provide debt. DEBT IS A BURDEN. Capital is not a burden. CAPITAL IS AN ASSET.

6. The authorities are not trying to remove risk from the banking system.

Bankers are too powerful – they control access to all the money not in circulation and they use it to provide governments with the loans which governments use to buy voters. Therefore, the authorities are not trying to remove risk. They are merely trying further to mitigate risk. They like the banking system as it is. It funds them! They are not trying to remove moral hazard. They benefit from it.

If you want your deposits in the Bahamian banking system to be safe, to be protected from the next banking and monetary collapse, both risk and moral hazard must be removed from the Bahamian banking system.

To remove them properly requires the passage of a new law in the Bahamas – a law which returns title of their deposits to Bahamian depositors. Ownership of the money in your cheque account must be returned to you!

7. The prospects for the US dollar are not looking good.

The Federal Reserve Bank continues to print money to support the banks and government overspending. The inflationary effects of the money already printed have not yet fully worked themselves through into wages and prices. The money-supply thus continues to increase and, once banks begin to lend again, the rate of increase will accelerate enormously. So, to will the rate of inflation. The value of the US dollar will then plummet to new and unprecedented lows.

Do we want the Bahamian dollar to plummet as well? Do we want hyperinflation here? I certainly hope not. The cost of living will skyrocket. The social and economic consequences are unthinkable – social unrest, uprisings, escalating crime are just a few of the possibilities.

Solutions

· To make our banking system completely safe, the Bahamian government needs to enact new legislation which will reverse the effects of the judicial decisions of 1811 and 1848.

· To protect our monetary system and the value of the Bahamian dollar, I believe we have little choice but to sever our present ties to the US dollar.

(The alternate is less appetizing. The thought of remaining tied to the US dollar and allowing the Bahamian dollar to join the US dollar as it plunges toward oblivion is very frightening indeed.)

To make the UK banks safe, Lord Caithness put a Bill into the House of Lords on January 30, 2008. The purpose of the Bill was to return title to their money to depositors. That Bill was not enacted and expired on April 6, 2010 at the end of the last parliament. Had it been enacted in early 2008, and thus become law, the UK banks would not have failed.

In the new UK parliament, a similar Bill has already been introduced to the House of Commons to return title to depositors and the Earl of Caithness is ready to introduce another Bill (to return title to the depositors) to the House of Lords at the appropriate moment.

Lord Caithness’s new Bill will make a good template for legislation in the Bahamas. I have copies of the draft Bill with me and am very happy to make them available to you.

Passage of a Bahamian Bill to return title to depositors will reverse the effects in the Bahamas of those mistaken judgments made in 1811 and 1848 in the UK. Then, your cheque account deposits will once more belong to you. It will be your money – not the bank’s money. Banks will then have a fiduciary responsibility to you. They will not be able to lend your money. Only you can do that!

You will, of course, have to pay for the services of storing and distributing your money. (Storing your money has never been free. You have paid for it through inflation.)

As I hope I have demonstrated, the largest producer of inflation is, in fact, the onward lending of depositors’ funds. That will stop. The only inflation produced in the Bahamas after that will be from government printing of money through either the printing press or the Central Bank of the Bahamas buying government bonds. Further legislation can make it illegal to create new money except under given circumstances – and even then only in limited quantities.

The current rate of inflation is in excess of 3% pa. No bank will charge you 3% pa to store your money for you. Most likely, you will be paying 1% or less.

You are currently paying distribution fees. Distribution fees are fees for withdrawal of funds, cashing cheques and using bank cards. They will continue.

Banks will not be able to lend your cheque account deposits. Savings deposits will be converted to holdings in an investment company which owns current bank investments. If you wish banks to provide investments for any new savings, you can buy shares or units in funds which they set up for this purpose. These funds will then make the investments.

Instead of the banks investing their money, you will be investing yours. You will be entitled to your share of the investment profits that banks have been making and keeping for themselves.

Under the new legislation, each bank will be required to maintain its own cheque account. When you buy a share or a unit from the bank, your money will come out of your cheque account and go into the cheque account of the fund in which you invested. Total deposits will not change. Then, when you pay bank fees, that payment will leave your account and go into the account of the bank. Total deposits will not change. Banks will no longer be able to increase the money supply. The Bahamian dollar will not be being debased and the money supply will be able to be accurately measured and controlled.

ONCE THE GOVERNMENT HAS ENACTED THIS NEW LEGISLATION AND BANKS MAY NO LONGER LEND, THERE WILL BE NO INFLATION IN THE BAHAMIAN BANKING AND MONETARY SYSTEM UNLESS THE CENTRAL BANK OF THE BAHAMAS PRINTS NEW MONEY.

Do you realize what this means?

1. The Bahamian banking system will then become the safest and the strongest banking system in the world.

As a result, the Bahamian currency could become in demand as a reserve currency – it certainly would be a ‘safe haven’. The financial services sector can boom. Investment in the Bahamas could increase significantly.

Other currencies will continue to depreciate. The Bahamian dollar will not.

In the Bahamas, then:

· The price of all imports will decrease. The price of foodstuffs, gasoline, medicines and other basics will fall and Bahamian wages will be able to purchase more. Everyone will feel better – as if they have had a wage increase.

· Our foreign currency reserves will increase.

· Existing foreign currency debt would be repayable with fewer and fewer Bahamian dollars.

· Exports will become more expensive – and that includes the costs to tourists. Tourism will need to focus more and more on providing higher standards in service and provisions. Some of our workforce will have to be retrained accordingly. Just as Canada had to make similar adjustments when its currency jumped 50% rather abruptly and Germany had to produce excellence in engineering when the Deutschmark was the strongest currency.

· These changes will remain until other governments follow suit – which they will because of the fine example we set.

2. The increase in foreign currency reserves will allow the Bahamas to pay off its foreign debt and there will be no circumstances under which the Bahamas will need to call upon the IMF to bail it out.

3. If it wished, the Bahamas could then withdraw from the IMF. (Not many are aware that under the rules of the IMF, members may not back their currencies with gold.)

4. The Bahamas would then be free to return to the gold standard if it so wished.

(It is not necessary to return to the gold standard so long as the printing of new notes and coins is strictly controlled. If it cannot be, then the gold standard acts as a natural control: gold cannot be produced out of thin air! That is one of the reasons why it served as a world currency so well for so many centuries.)

After having enacted the required legislation, there will still be an imbalance in each bank that will need to be addressed. At the moment of conversion of the Bahamian banking system, no bank will have sufficient cash to meet every possible withdrawal. That needs to be corrected.

We in the Bahamas are very fortunate because the Central Bank of the Bahamas has been very careful in its supervision of banks here, and this shortage of ‘cash’ can be easily resolved.

At the end of last year, December 31, 2010 the banks had deposits of B$1,205,033,000 in cheque accounts. They held cash of B$113,117,000 plus deposits with the Central bank of B$518,706,000. This left them short by B$631,833,000.

Banks also hold B$1,093,244 of Treasuries and other Bahamian Government securities.

If the Bahamian Government printed new notes and bought back B$631, 833,000 of those securities for cash, the banks would then hold B$1,205,033,000 in deposits for depositors and B$1,205,033,000 in cash. All withdrawals could then be met!

(This printing of money will not produce any inflation as it will merely replace digital money with actual cash and, therefore, will not increase the money supply,)

BAHAMIAN BANKS WOULD THEN BE 100% FREE FROM RISK AND 100% FREE FROM MORAL HAZARD.

BAHAMIAN BANKS WOULD THEN BE FULLY SAFE, WHATEVER HAPPENED TO THE BANKING SYSTEM IN THE REST OF THE WORLD!

In addition,

· The government would save $30 million per year on interest costs.

· The banking sector would increase its profits by $33 million.

THOSE ARE ALL PRETTY POSITIVE CHANGES!!

What of the investment sector?

The investment sector will now need to be completely separated from the cheque account sector. These two sectors must have no direct connection. In that respect, the investment management division of each bank will become like – and compete with – any other investment management operation and they should both be governed by the same rules.

At the moment, banks are restricted to lending. As investment managers, they will need to be given wider options to compete with other investment managers. They will need to be able to make equity investments. Banking regulations will need to be changed accordingly.

Some of the investment funds that banks operate could seek investments in Bahamian start-up companies, others could seek investments in Bahamian growth companies, others could focus on local income producing investments and others will seek investments in Bahamian housing stock or commercial property. Others might invest through local stock markets as these develop.

Depositors who wish to invest their savings and move it out of their cheque accounts, will have a wealth of choices for investing. A myriad of depositor will make these investment choices – not the bank managers. This will provide a much wider scope for those seeking investments. Further, the soundness of the investment opportunity will be the criteria for investing – not the assets already owned by those seeking investment.

Those seeking to raise money for their businesses will have a different choice than they have now. Rather than having to borrow money, they will be able to seek equity investment by offering shares in their businesses.

They will be able to offer investors both ordinary shares and preference shares. For those who wish to retain full control of their businesses, the shares offered could be voting or non-voting shares.

Preference shares can carry a fixed rate dividend which must be paid before ordinary shareholders receive any payment whatsoever. Where preference shares are cumulative, if a company has a difficult year and cannot pay its preference share dividend, that year’s dividend is added to the next year’s dividend and the company cannot pay any dividend to ordinary shareholders until all preference share dividends have been paid. This gives preferred shareholders protection and, at the same time, can allow businesses to pay key personnel during a downturn – keeping them on, ready to take advantage of any upturn.

Preference shares also have first claim on all of the assets of the company. In these two respects, they are much like a loan – except preference shares need not be redeemable or may be redeemable at the choice of the company. The money can remain in the company for continued use. Preference shareholders who wish to regain their money will simply sell their preference shares to someone who is looking for an income producing investment.

With loans, on the other hand, the principal must be repaid and the money must come out of the company. If a business borrows money and fails to meet interest and principal payments, the business can be shut down causing everybody to lose their jobs. There will be no threat of bankruptcy from failure to meet interest or capital repayments under an equity based financial system.

These changes will lead to:

1. New and vibrant financial markets will emerge at all levels, local, regional and national, provided there are no restrictions on their development. These markets will be driven by demand:

a. on the one hand, by the desire of all those who wish to invest their savings rather than pay storage on them – thus increasing the demand for investments,

b. on the other hand, by the need for money to develop and expand business activity.

2. Housing finance will continue through funds established for that purpose. Some housing finance funds will continue to offer mortgages. In these funds, should a home-owner fail to make payments and a foreclosure occur, any loss by the fund, will be borne by the investors in that particular fund alone.

There will be no lender of last resort. The banking system will not be on the hook. Your deposits will not be at risk.

When all of the money in a housing finance fund has been invested, the fund will not be able to issue any new mortgages until more money is raised.

Other forms of housing finance should develop to fill any demand for more housing finance. We may well see programmes develop along the lines of the many shared-ownership programmes which now exist around the world.

3. Car dealers may well operate their own leasing companies as they used to.

4. Shops will offer their customers credit in a variety of ways. Some will return to the programmes of accepting deposits and setting items aside for the customer until these items have been fully paid.

5. Debit cards will become the normal means of payment.

The new and vibrant markets created, driven by the choices of many individual savers and not restricted to banking criteria, could drive the economy of the Bahamas to new and unseen heights.

All of the above is achievable if we can encourage the government to pass legislation to return title of their deposits to depositors.

In our existing system, the loss or ‘theft’ of purchasing power in paper money is destroying trust in the capitalist system throughout the world. Witness the protesters in Wall Street and elsewhere around the world. Witness the loss of faith in government securities in the markets. Witness the loss of faith in the interbank lending markets. Producers of raw materials are no longer willing to enter into fixed long term contracts without regular price revisions. They have been robbed of purchasing power too often and are now unwilling to trust the people with whom they wish or need to do business.

Too much human endeavor has become focused on the short term. Too many now believe they must earn as much money as possible in the short term before that money loses even more purchasing power. A culture of ‘greed’ has been fostered.

All of the above flows naturally from ordinary bank lending.

Who can we blame today? Is it the fault of the government, the banker or the depositor? Yes and no to each. Yes, in that we have each allowed it to happen and we each continue to allow it to happen. No, in that we have each found ourselves born and raised within the system as it is. We have been conditioned to trust it and have each done our best to survive within it. Like those who for centuries believed and acted as if the world was flat, we have all merely failed adequately to question the system within which we have found ourselves.

There is no point in now trying to apportion blame. Those who made the original mistakes died centuries ago. Those of us alive today, bankers, regulators or depositors should not feel responsible for the mistakes made centuries ago. However, once we have seen the faults within it, we must concentrate our energy on properly fixing this failed banking system.

We in the Bahamas now have the opportunity to restore genuine stability to the Bahamian dollar. The reform of our banking system and the separation from the U.S. dollar that I outlined above will stop further loss of purchasing power by the Bahamian dollar. Each of us can then begin to make more accurate measurements of exchange value and that will allow us to make better decisions. Nevertheless, we must remain aware that much of the data already stored in our memories is distorted and inaccurate. We will each only be beginning the process of correcting our own thinking. The process will take a long time. In our own minds, we have each accumulated years of experiences, calculations and decisions – all based on inaccurate information. We each may well have used our energy pursuing courses we would not otherwise have pursued and much of it will have been wasted. Patience and understanding will be required. We are all in the same boat.

The authorities around the world are not going to change their approach to ‘fixing’ the banking and monetary systems. They will continue ‘printing’ money in order to continue to bail out threatened banks. They genuinely believe what they are doing is correct – even though it continues to fail. Centuries ago, the authorities genuinely believed the world was flat. They, too, didn’t change their beliefs until they could no longer avoid reality.

I believe that it is now self-evident that we must begin to protect ourselves. I believe the future of civilization as we know it depends upon someone setting the right example now. I would like that someone to be the Bahamas.

Last time I spoke to the committee of the Nassau Institute, I also promised to address the requirements of a free market and how to maintain a freedom in society. With your permission, I would like to address that now. As is usual for me, I begin by looking at the basics. If we don’t have those clear in our minds, we can easily misunderstand what is happening.

Economics is the study of human action. Human action is about human energy. From the moment we are born we expend our energy in one direction or another. We cannot spend our energy without replenishing it. Initially we replenish it from our mother’s breast. Then we replenish it through eating.

There is a relationship in nature between the energy we receive from what we eat and the energy we expend to both get the food and to eat it. For instance, if we expend more energy finding, picking, cleaning, biting, chewing, swallowing and digesting an apple than we receive from eating it, we are unlikely to do it twice.

When we were nomadic we were free to pick an apple eat it. Then we settled on the land. With that came property rights and laws to protect property. Some people owned and controlled land and others didn’t. Those who didn’t had no legal access to apples. They had to ask the owner of the land if they could pick one.

The owner of the land could then require them to pick two and leave him one or, perhaps even to pick one hundred and leave him ninety nine.

In both cases, the owner of the apples would have required the hungry person to expend more energy than nature intended. The hungry person would have had to expend either twice or one hundred times the energy nature intended to access the energy received from eating one apple. That is contrary to the relationship nature intended. In that sense it is unnatural.

Throughout the course of history, whenever those who control of the essentials for human survival have required those who are not in control to behave too unnaturally – however that is interpreted at the time – revolutions have occurred.

The most significant change occurs when the second hungry person asked for an apple. The owner of the apples will not need him to pick two or even one hundred. The owner will already have apples from the previous person. Therefore he would ask the second hungry person to make something else or to perform some other service in exchange for an apple.

That is how we became the only species (of which I am aware) that busies itself producing what it doesn’t want in order to exchange that for what it does want.

From the moment we settled on the land, we have all lived in what I call a MANDATORY EXCHANGE SOCIETY from within which we have had to exchange to survive. That’s why we work. In this, we have no choice. That, of course, flies in the face of the concept of liberty.

Most of us have not thought about how we got here. Most of us simply accept that we have to work to survive and to take care of our families and we try to generate as much choice as we can about what work we do and when we do it. We tend to look at liberty within this understanding.

When we look around our islands and the rest of the world, we see many unemployed, we see pockets of poverty, we see many uneducated or poorly educated youngsters and adults and we see many ill, all of whom are unable, in one way or another, to work and meet the requirements of this mandatory exchange society. They cannot provide for themselves or for their families. The mandatory exchange society does not offer them the freedom not to exchange. Yet, they cannot.

They need to be helped. The question then arises: who will help them? How we answer that question determines the type of society we live in.

If we believe that it is not our responsibility as individuals, then others must. If no individual or group does, then governments must. If governments do, then governments must raise the money with which to do it.

Over the past century, in most societies, since the introduction of the income tax, the solution for the many disenfranchised of this world has been for the government to provide for them. This, in turn, has led to politicians using taxpayers’ money to provide for those less fortunate.

These politicians are people with good intentions who offer to do-good at someone else’s expense – not at their own expense. The state is then required to use its coercive and confiscatory powers to collect taxes from its citizens to pay for the services that its politicians have offered to those unable to provide for themselves. There is nothing voluntary about this. This process is known as Socialism.

Socialism removes the responsibility for looking after others less fortunate from individuals and transfers it to the state. So, successful individuals living in a socialist regime can simply pay their taxes and forget about those less fortunate. They need worry about only themselves. As individuals continue to focus on themselves alone, we soon find ourselves in a ‘me’, ‘me’, ‘me’ society.

In order to get elected, many Socialist politicians deliberately confuse equality of opportunity with equality of living standards and promise the electorate more and better. They then need to raise even more taxes to pay for the new promises they make. Thus, the taxpayer gets to keep less of his earnings whilst the recipient of this largess develops a dependency on government.

Taxpayers have no choice because the state employs its coercive and confiscatory practices to collect these increased taxes to finance its largess.

In the name of fairness and equality of living, these socialist politicians have introduced more and more rules to govern individual behavior. Each of these rules restricts choice and removes one more of our God-given freedoms after another.

Now, many western countries find themselves bound in red-tape – rather like Gulliver in Lilliput. These societies find themselves divided and battling on two fronts. On the one front some battle to help those increasingly disadvantaged by the continuing inflation which we have already addressed and on the other front some battle to regain much of the freedom lost.

Unfortunately, whilst these socialist policies do provide humanitarian solutions for those less fortunate, the cost is that we each continue lose more and more of our individual freedoms in the name of protecting the vulnerable.

I argue that the vulnerable can better be protected without the loss of freedom or the confiscation of individual and group wealth.

When the original thinkers of free market economics lived and wrote, the Judeo Christian ethic was alive and breathing. There was an underlying understanding of morality and how to behave. People understood their responsibilities to each other as well as their rights. Today, in too many people, that understanding no longer exists. They understand their rights but not their responsibilities to each other.

Today, too many people are really looking for a license to improve their own position without regard to the position of others. The world today has become too focused on “me”. The cause of freedom has been hijacked by the greedy.

This can lead to those of us who are genuine advocates of free markets being seen as ‘heartless’, ‘nasty’ and ‘uncaring’. The socialists then use these labels at every election to win votes. If we are not careful, this can lead to further losses of our freedom and, in due course, a total loss.

If we wish to regain lost freedoms and not lose further freedoms we must awaken to the danger of failing to understand or even be aware of our own responsibilities in a free society.

None of us can be totally free to choose the direction in which we each wish to employ our own energy unless each and everyone else is equally free to so choose.

The problem faced by those who cannot provide arises because we have forgotten how to live in a voluntary exchange society or a free market. Instead we seem to think that God made man to work and without question we accept that we live in a mandatory exchange society and that the unemployed of this world have to get on their bikes and find a job to survive whether or not there are jobs available and whether or not they are capable of handling a job.

Too many who seek to implement a marketplace served by voluntary exchanges, seem to assume that ‘the market’ will take care of the jobs required. Unfortunately, it doesn’t always work out that way – as we can plainly see today. Medium to long term unemployment is always a sign that the market hasn’t provided adequately and that we need to do something about it ourselves.

We must recognize that we are the market. You and me! We can and must ourselves ensure that those less fortunate receive the help they need, and we must ensure that it is provided within the voluntary or private sector. We must demonstrate that the private sector can and is willing to take care of all the vulnerable people of this world. We can best demonstrate that by doing it here in the Bahamas.

When the private sector provides, the state will no longer need to use its coercive and confiscatory powers to interfere in any day to day operation of our lives except where our individual actions threaten the free choice of others.

To develop and ensure a free market, we must begin now, in the private sector, to provide even better social services than those which the government now provides. Once we have them up and running – and running successfully – we can genuinely ask the government to begin to withdraw the services they now provide. Government budgets can then be reduced. Taxes can be reduced and government interference in our lives can be minimized.

So, what can those of us that wish to see a free market do as responsible citizens?

· We must each ask ourselves, how much time can we individually devote to ensuring that the needs of the less fortunate are properly met. We must each ask: how much money can we each individually spare to ensure these needs are met?

Some of us will be able to devote time and not money and vice versa. That’s OK. Let’s begin!!!

· We must, each of us individually, help to establish in our own community a network of people of similar interests: a network which is capable of identifying those within our communities who are ill, incapable or simply unemployed.

· We must then examine the causes of each inability and see what we ourselves, and those within our network, can do to help them and to help to remove the impediments they face.

· Then we must begin immediately to provide the help required.

· When all obstacles have been permanently removed and everyone is free to make voluntary choices and when the needs of those who cannot participate are met, the government can then withdraw. A genuine free market can then exist.

· We must then continue to monitor our network to ensure that any new impediments are removed and any people newly impeded are similarly assisted.

What does that mean here in the Bahamas?

· First, let’s recognize that we have far less socialism than most western economies. Thus, we have far less government interference. Thank God for that. We don’t really want to go any farther down that road.

Yet, we have already gone sufficiently far down that road that according to yesterday’s paper: ‘the Bahamian government appears to be running an “irreversible” increase in debt accumulation due to deficit spending and that our debt will continue to grow until the world economy begins to grow sufficiently that our revenue can increase faster than our expenditure.’

This is a further sign to act now. We are not in another economic cycle. Recovery is nowhere in sight.

However, by making the changes to the Bahamian banking system that I have outlined above and by separating the Bahamian dollar from the U.S. dollar, we can encourage an increase in foreign exchange revenues which will help us to repay debt and reduce our debt servicing costs. Further government expenditure reductions can be achieved by reducing social programme costs when we implement private sector social initiatives.

· Second, let’s recognize that we in the Bahamas already have a very good voluntary sector doing much in these very areas. Yet, there is so much more to be done:

1. We must acknowledge and support the excellent work already being done in the private sector with adult education in teaching adults who cannot, to read and write. This is only a beginning and much more needs to be done. We must ask what more we can each do to help those already helping.

2. Some four to five thousand youngsters graduate from Bahamian schools every year. Some of those graduates have adequate education and can find work, others have inadequate education and cannot. To improve our education standards, I suggest we consider how we might help the Bahamas to benefit from a recent study by Andrew Coulson which showed how private sector education has replaced public sector in many areas and is not only better, but less expensive. This research could help us find a way forward to improve our schools and help future graduates.

3. For those who have already graduated and still remain ill-equipped, we could consider initiating an outward-bound type of residential school, perhaps on one of the out islands. One such programme was recently featured in the local paper. It seems a great step forward. We must do what we can to assist in its development as well as to encourage others and help them all to finance worthwhile initiatives.

We can certainly learn from the good work being done around the world by the Duke of Edinburgh’s Award Scheme and the Prince’s Trust. These are but two very effective schemes designed to help the young to improve themselves. There are others and we must study them all to find the best ways to help our young. I am sure there are many in the Bahamas who have ideas of their own.

4. In any event, there are few jobs available and certainly not sufficient even if every youngster had a fully adequate education. We must seek ways to promote entrepreneurial behavior amongst our young graduates and develop systems to support those who are willing to try.

We must appeal to the business community to establish a Venture Capital Fund to support these individual entrepreneurial ventures. We must all be prepared to accept that some will fail. Others will succeed. We must build on the successes.

I noted (also in yesterday’s Tribune) that the Bahamas Credit Union League has been trying to meet some of this need but face a 50% rate of delinquency. We must thank them for trying. However, venture capital should not be provided by debt using someone else’s money. There will always be some failures in venture capital investments and failures lose the capital. How, then, can depositors possible be repaid?

Venture capital is a field for equity investors who understand that a 50% success rate can still be profitable and are who prepared to accept the failures.

The government has already begun to meet that need with its own venture capital fund. So, too, has ‘We the People’. Yet, governments should not be doing this with taxpayers’ money. Where is the rest of the private sector?

We must also ask: what can we do to bring manufacturing to the islands? What kind of manufactured products will suit and benefit the Bahamas? Can we encourage more and better agriculture? What about olive plantations? Can we encourage some manufacturing that will help to develop a skilled workforce here in the Bahamas? There are so many possibilities.

5. With respect to the poor, we must find the means to harness the excellent networks that already exist in the churches, the Red Cross, charitable bodies, etc. to identify those in need. Where these networks fall short, we must develop other networks.

Then, through our own efforts and contributions we must find ways to help those identified as genuinely less fortunate to help themselves where they can. Then they, too, can help those around them. Where they cannot, we must help to provide for them.

6. We must help the ill to receive the medical attention necessary. This may well mean both help with the provision of benefits and help with improving our available health services.

All of the above we must do through the private sector in both ‘for profit’ and ‘not for profit’ ventures.

7. To help to pay for some of these private sector provisions, we might establish a ‘Society for Assistance for the Less Fortunate’. We must then all be prepared to contribute to it what we can.

8. The most important thing for us all to remember is that we must see to it ourselves. We must do it. We must not call upon someone else to sort things out.

For instance, in the October 29th edition of the Tribune, there was an article about the state of Englerstone Park and the dreadful state into which it had been allowed to deteriorate.

“Frustrated residents demand action” the headlines ran. Why aren’t these residents cleaning it up themselves and setting an example to the community? That’s the sort of behavior we need to see in every walk of life.

These are just a smattering of thoughts about some of the things we can do to ensure a voluntary exchange society can exist here in the Bahamas. I am certain that amongst this audience and the wider population, there are a great many more and better ideas that can all help to make our society better and freer.

The truth is: if we don’t do these things ourselves, the government must. That means more cost to the government which, in turn means more revenue is required. Eventually, if we don’t act, the government will have to impose further taxes and eventually an income tax. Then we, too, will be on the road to serfdom.

To avoid this route, we must shoulder the responsibilities of good citizenship and see to it ourselves. It’s that simple and it’s time to start now.

In summary:

1. The world banking system is likely to suffer a much larger collapse than that of 2007/2008. Therefore, we ought to take the necessary steps now to strengthen the Bahamian banking system so that it can withstand any future international financial collapse.

2. The banking system needs to be fully protected because we use it to store our money – the money we set aside to meet our family and our business budgets. We need it stored safely. ‘Safely’ means both free from theft and free from loss of purchasing power.

3. We can and should strengthen and protect the Bahamian banking system by passing new legislation which returns title of their deposits to depositors and liquidating sufficient bank investments to ensure that banks hold sufficient ‘cash’ to return every deposit simultaneously. The banks will then be fully protected and your deposits will be 100% safe. Banks can be more profitable. The government can reduce its interest costs.

4. The Bahamian dollar is currently tied to the US dollar. The US dollar has been falling in value and, as a result, so too has the Bahamian dollar. I believe the US dollar is set to fall precipitously. Do we wish to allow the Bahamian dollar also to fall precipitously? I do not. I hope you too, do not. I hope the government does not.

5. Economic growth could then continue in the Bahamas regardless of the state of the rest of the world.

6. We must then focus all of our attention on ensuring that we develop and maintain a genuine free market in the Bahamas through developing:

a) Private sector improvements to our education,

b) Private sector improvements to job creation,

c) Private sector improvements to help for the less fortunate and

d) Private sector improvements to our health provisions.

Then we can truly set an example to the rest of the world and say with meaning “ITS BEST IN THE BAHAMAS”!

John Tomlinson

November 2011