Over the past year or so, The Nassau Institute has been offering serious food for thought on The Bahamas Monetary System and what might work best.

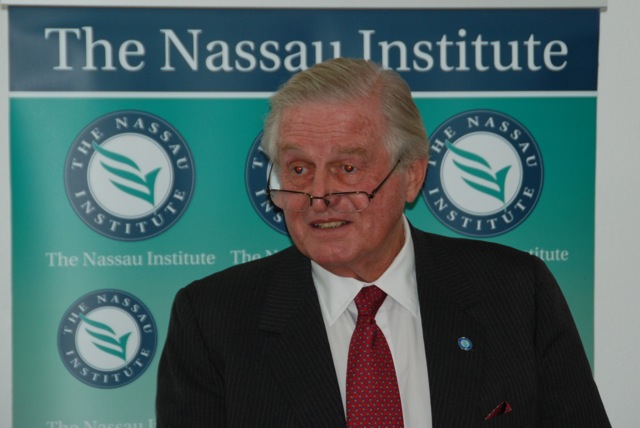

Back in March 2010 Dr. Lawrence H. White, Professor of Economics at George Mason University recommended The Bahamas: [Watch his presentation here… http://bit.ly/iT2naC ]

Back in March 2010 Dr. Lawrence H. White, Professor of Economics at George Mason University recommended The Bahamas: [Watch his presentation here… http://bit.ly/iT2naC ]

1. Have a super fixed exchange rate – This would take away the “indignity of exchange control”.

2. A Currency Board, based on the US Dollar would be an improvement.

3. Privatisation of the currency would even be an improvement over the Currency Board.

Then in May 2011, John Tomlinson, a former stock broker with Thomson and McKinnon and a merchant banker with Ord-BT in Sydney, Australia, who used to run Union Dock here in Nassau, (his family has been resident here in The Bahamas since 1963), offered suggestions on how The Bahamian Dollar can be made secure.

Mr. Tomlinson opines returning title of money to the depositors where banks would store money for a fee. This way banks would be free from Moral Hazard and the Bahamian Dollar would be secure.

This leads to an investment sector where banks would offer funds for depositors to buy shares in the mortgage portfolios or start up companies and more. [Watch his presentation here… http://bit.ly/lKazTr ]

Like The Atlas Economic Research Foundation that launched the Sound Money Project [http://www.soundmoneyproject.org/] under the guidance of Ms. Judy Shelton, the goal of the Nassau Institute is “to stimulate more public discussion on the appropriate role of monetary policy in a free-market economy.”

So where is all this headed?

According to the AP news service, “Utah legislators want to see the dollar regain its former glory, back to the days when one could literally bank on it being “as good as gold.” [More… http://apne.ws/lUjsmW ]

In a follow up article by ABC News, Dr. White is quoted as saying:

“We are just now starting to see some interest. These actions by state legislatures are mostly symbolic — declaring that people can use a one-ounce federally-minted gold coin at its face value of $50 doesn’t really give people a reason to do that. But it’s a statement by the state legislators that they are concerned by the state of the dollar,” said Lawrence H. White, a professor of economics at George Mason University who has published several reports on the topic. [More… http://abcn.ws/i6jVWo ]

These are exciting changes that could ultimately bring sanity to Monetary Policy in the United States and of course here at home in The Bahamas.

When The Nassau Institute contacted Professor Lawrence White recently to ask if there really could be a shift back to the Gold Standard [ http://bit.ly/w3yBo ] he remarked, “If US inflation begins to approach 10%, a shift toward greater interest in using gold as money could also begin.”

Hopefully a shift will occur naturally without yet another major shock as the world economies have been experiencing over the past few years as a result of ill conceived monetary policy.

Background:

Why Private Banks and Not Central Banks Should Issue Currency, Especially in Less Developed Countries. Lawrence H. White and George Selgin – http://www.econlib.org/library/Features/feature3.html

Is the Gold Standard Still the Gold Standard among Monetary Systems? Lawrence H. White. [ Cato Briefing Paper: http://bit.ly/czBIJq ]

Lawrence H. White is a professor of economics at George Mason University. Prior to position at George Mason, he was the F. A. Hayek Professor of Economic History in the Department of Economics, University of Missouri-St. Louis. He has been a visiting professor at the Queen’s School of Management and Economics, Queen’s University of Belfast, and a visiting scholar at the Federal Reserve Bank of Atlanta. [ http://mercatus.org/lawrence-h-white ]