This article was written by Richard Fulmer and originally appeared in The Freeman. It is reprinted here with the kind permission of the Foundation for Economic Education (FEE).

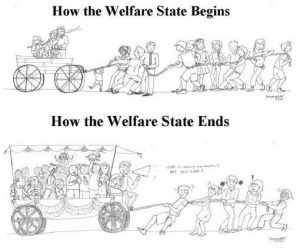

This article was written by Richard Fulmer and originally appeared in The Freeman. It is reprinted here with the kind permission of the Foundation for Economic Education (FEE). Welfare states face an inescapable paradox: The level of production needed to sustain a welfare state cannot be sustained by a welfare state. This paradox is created by policies that encourage the redistribution and consumption of wealth while discouraging its creation. In the face of such perverse incentives, living standards must fall even though, for a time, they may be maintained through borrowing. The paradox is not unique to Greece or California, nor is it a function of who is in charge. It is, rather, inherent in the internal contradictions of the welfare state itself.

The term “welfare state” is defined here as a polity that assumes primary responsibility for the care of a good number of its citizens, providing such benefits as public housing, health care, education, minimum wage rates, unemployment insurance, and financial support for the poor, elderly, disabled, and politically favored institutions, businesses, and industries.

The material well-being of any society’s people rests on the quantity and quality of goods and services they produce. All goods and services consumed by the unproductive members of society must be taken from, or paid for by, the productive. Welfare state policies ensure that the ranks of the unproductive will grow and those of the productive population will shrink, and that the productivity of the dwindling number of producers will fall. As a result, the quantity and quality of goods and services available will drop and poverty will rise. The mechanics of this decline are both straightforward and predictable.

Welfare state policies discourage saving. When government helps pay for its citizens’ big-ticket items, citizens have little need to save for the future. Banks will therefore have less money to lend, leading to lower capital investment and lower economic growth. The taxes needed to pay for public benefits reduce the ability of, and incentives for, businesses to maintain and expand production facilities. To the extent that taxes are paid by consumers, or passed on to them through higher prices, they will have less money to save, further reducing private capital.

Loss of Productivity

Minimum wage laws, unemployment insurance, employer mandates, and regulations that make it difficult to fire workers all drive up the cost of employment, resulting in less of it. High corporate taxes will drive some businesses out of the country and others into bankruptcy, further adding to unemployment rolls. Demands for protectionist legislation will become more insistent as jobless rates rise. If these demands are met, even more jobs will be lost as foreign commerce collapses amid escalating trade wars.

As benefits and benefit recipients multiply, and as the number of taxpayers declines, the latter will be less and less able to bear the ever-growing burden. Many of the most productive and adaptable will move to countries that allow them to keep more of their earnings.

While productivity increases can help offset falling production due to a declining workforce, any such increase requires either capital investments or innovative process improvements. As previously explained, however, welfare states discourage capital formation by discouraging savings. Innovation is similarly discouraged by taxes that reduce or eliminate any profits that such innovation might generate.

Depleting the Ranks

As the population of unproductive citizens grows, either through job loss or through aging, government bureaucracies will also grow to meet this rising need. In addition, as more taxes are levied to pay for the bureaucracies and the programs they administer, government tax collection agencies must expand as well. This further depletes the ranks of the productive, channeling them away from producing wealth to merely redistributing it. Civil servants are typically paid more than their private-sector counterparts and are generally able to retire earlier and on more generous pensions than employees in the private sector, further adding to the burdens of productive workers. Moreover, the growing ranks of public employees form a powerful voting bloc strongly favoring increased government spending and more government control over the economy.

Institutions will grow up around the welfare state, increasing the number of people with a stake in its continuation and growth (and further decreasing the number of productive workers). For example, advocacy groups and law firms will form to help people obtain government benefits and to demand more of such benefits. Service providers, such as tax accountants, will spring up to help people deal with increasing bureaucratic complexity.

Special interest groups like AARP will funnel campaign funds and votes to pliable politicians. These private institutions will combine with government agencies in symbiotic, mutually reinforcing alliances. Elected officials can garner votes by acting as advocates for constituents forced to deal with unresponsive public agencies. Government departments, wishing to expand their “customer base,” will work to make government support easier to obtain and available to more people.

Job loss, unpleasant in a free-market economy, is softened by government-provided unemployment insurance in a welfare state. Some will find paid unemployment agreeable and will delay their return to work, perhaps indefinitely. As more parents become wards of the State, more and more children will come to see this as normal, and generations of families living on welfare will become commonplace.

Advocacy groups and government agencies charged with providing benefits will work to reduce the stigma associated with receiving public aid and to justify taking from those who work to give to those who do not. Poverty must, therefore, be portrayed not as a consequence of self-defeating actions or poor choices—and certainly not of government action—but as the result of bad luck or oppression. Conversely, wealth must come to be seen not as the outcome of hard work and perseverance, but good luck or greed and exploitation. The very concept of virtue must be questioned and stood on its head as the Tenth Commandment morphs from “Thou shalt not covet thy neighbor’s goods” to “Thou shalt not have goods thy neighbors covet.”

Feedback Loops

Imagine how dangerous the world would be for a person without the ability to feel pain (as happens with certain forms of leprosy). Such a person could hurt himself terribly by continuing to walk on a badly sprained ankle or putting his hand on a hot stove without knowing it. Government largess can create a sort of moral leprosy by weakening or even destroying feedback loops linking cause and effect. As the consequences of self-destructive actions (such as dropping out of school, having children out of wedlock, or drug and alcohol abuse) are increasingly borne by others, the incidence of such behavior will rise. At the same time, as the benefits of hard work, perseverance, and integrity fall, such virtues can be expected to fade.

The philosophy underlying the welfare state, “From each according to his ability, to each according to his need,” leads people to display minimum ability and maximum need. To the extent this philosophy is actually followed—more often, wealth flows from the politically weak to the politically strong—people will band together along ethnic, gender, religious, and other lines to compete to be seen as the most needy and therefore the most worthy of a larger share of an ever-shrinking pie. This downward spiral of competitive self-destruction may well create a permanent underclass that carefully avoids success and embraces failure—that is, which acts sensibly in the face of perverse incentives. This competition for tax dollars may create deep, irreparable fissures between recipient groups and between recipients and taxpayers.

As government grows it will increasingly be seen as the answer to any and all difficulties, and people will demand government solutions to increasingly minor inconveniences. Legislatures will respond by enacting ever-more-stringent regulations on individuals and industry, further reducing adaptability, independent and entrepreneurial thought, risk-taking, and productivity. Centralized, bureaucratic rule will erode people’s self-reliance, initiative, and sense of local community.

When government begins providing people with goods and services they can provide for themselves, it launches a self-reinforcing trend that will eventually become unsustainable. Once the practice of taking from one citizen to give to another becomes established, politicians will be unable to resist the urge to bribe voters with their own tax dollars. As legislators’ rewards for spending other people’s money grow, spending will grow.

The time it will take a country to spend itself into bankruptcy depends on its initial economic strength and the strength of its culture. But whether it takes one generation or ten, unless the trends reverse, bankruptcy must come. Time can be gained by borrowing or printing money, but other countries will eventually stop accepting the nation’s debt—whether it is in the form of government bonds or in the form of fiat currency.

In the case of the United States, the country is not yet bankrupt, but bankruptcy will soon be in sight if current policies are not changed. Social Security will go into the red this year and Medicare will shortly follow with even larger deficits. Current estimates of U.S. debt are on the order of $13–14 trillion, an amount equal to the country’s entire gross domestic product. As monumental as that number is, it pales in comparison to the present value of the unfunded liabilities of Social Security and Medicare, which total $107 trillion.

Of all the changes wrought by the welfare state, a degraded, dependent culture will have the deadliest impact and will be the hardest to reverse. Yet the culture must be changed. This can occur only if government-created incentives that encourage people to live at the expense of others are replaced by market-created incentives encouraging the production of goods and services that people want. Creative marketplace competition to produce more and better products must supplant political competition for an ever-dwindling pool of tax dollars extracted from an ever-dwindling pool of productive workers.