The Nassau Institute has kindly forwarded to me the letter commenting on my talk to them which was published on August 26th written by INTERESTED SPECTATOR. In it, the author was critical of my suggestion that the Bahamas should break its tie with the U.S. dollar and offers two scenarios to support his (or her) view.

The Nassau Institute has kindly forwarded to me the letter commenting on my talk to them which was published on August 26th written by INTERESTED SPECTATOR. In it, the author was critical of my suggestion that the Bahamas should break its tie with the U.S. dollar and offers two scenarios to support his (or her) view.

In the first scenario the U.S. Dollar fell against the Bahamian Dollar. This certainly will happen if the Bahamas makes the changes to the banking system that I suggested and this fall will make it more expensive for U.S. tourists to visit the Bahamas.

That does not mean that U.S. tourists will stop visiting the Bahamas as the author seemed to suggest, threatening ‘5,000 jobs’. The Bahamas has a lot more to offer than cheap tourism.

Recently the UK Pound, the Euro and the Canadian Dollar have all risen against the U.S. Dollar – not because any of them changed their banking system. They have risen because the U.S. has a policy of depreciating the Dollar against other currencies for two basic reasons:

- to make their products more competitive on the world markets and

- to reduce their debt via inflation.

Nevertheless, these increased costs have not stopped ordinary U.S. tourists from visiting the UK, Europe or Canada.

The second scenario suggests the U.S. Dollar could rise against the Bahamian Dollar. This could occur in the absence of the changes I had previously suggested be made before I suggested breaking the tie:

- Return title to their deposits to depositors,

- Restore enough cash to the banks to ensure every deposit is fully covered and all withdrawals can be met in full at any time,

Following those changes, banks could no longer lend depositors’ funds and would thus stop creating new money out of thin air. Then, so long as the Bahamian government did not create any new money itself, the number of Bahamian dollars in existence would not increase and the market would begin to establish its real exchange value. It would no longer continue to depreciate.

In the absence of the U.S. government making similar changes, the U.S. government would continue its policy of letting the dollar fall against other currencies. It would continue to depreciate. Therefore, the Bahamian Dollar could not fall against the U.S. Dollar. So, this scenario is not a real possibility.

In two small paragraphs near the very end of my talk, I did say the Bahamian government, if it so wished, could then adopt the gold standard. However, this is not necessary if sufficient measures are in place to keep the government and the central bank from printing new money and increasing the money supply. One of the great advantages of the gold system is that it soon exposes any government that depreciates its paper currency.

The thrust of what I said in my talk was that the Bahamas should change its banking system to protect depositors and the banks from the next major banking and currency collapse and make it safe for future generations . This change was a pre-condition of everything else that followed.

Many people seem to believe that we are experiencing just another economic cycle and that, as the downward movement of the cycle ends, the value of U.S. dollar will again rise as it is the world’s number one reserve currency. It certainly was the world’s number one reserve currency. It is now very suspect and U.S. credit ratings have been reduced. Investors are now seeking something of more realistic value. That’s why the price of gold has gone up.

Further, I believe a more realistic scenario is that what we are experiencing is not just another economic cycle. It’s more like the 1930’s where, to save the paper money system, a meeting of the world monetary authorities was held at Bretton Woods and the world monetary order was rearranged. However, now there is little more such rearranging that can be done. Instead of another cycle, I believe we are living through the end of the paper money system as we know it.

Banks and governments have been printing money excessively. The question investors are now asking is: what is paper money worth? Paper money is backed by government promises and governments making these promises are now virtually bankrupt. Thoughtful and sensible investors are now shunning paper money in favour of something with real intrinsic value – not promises.

Unless and until governments and banks stop printing new money and remove their burden of debt – as I have recommended to the Bahamas – there is little hope for a sustained return to confidence in paper money.

If the Bahamian authorities adopt the programme I suggested, then all of the other benefits to the Bahamas which I outlined in my talk will accrue to the Bahamas and to the Bahamian people, including shopping being even less expensive in Florida.

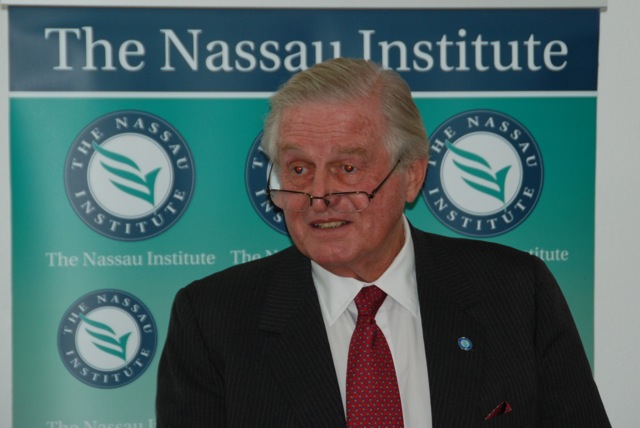

John Tomlinson

Portugal

August 30, 2011