by Richard Coulson

The article “Demise of The Bahamas as an Offshore Financial Centre” contains major truths about our decline that cannot be discounted. However, in placing the blame on the demands of EU, OECD, FATF and IMF and our own craven failure to fight back, the author ignores one major factor in the decline that our lawyers don’t like to talk about: their own reactionary policy of not permitting foreign lawyers to set up permanent resident practices here.

Offshore financial services no longer depend on how many banks or trust companies a jurisdiction can boast. Increasingly, they depend on teams of lawyers, tax specialists, accountants, financial administrators, risk analysts, and investment advisors capable of serving the complex needs of giant international companies and investment funds.

Offshore financial services no longer depend on how many banks or trust companies a jurisdiction can boast. Increasingly, they depend on teams of lawyers, tax specialists, accountants, financial administrators, risk analysts, and investment advisors capable of serving the complex needs of giant international companies and investment funds.

Our offshore competitors in Bermuda, Cayman, BVI, Channel Islands and many newer centers like Dubai and Mauritius have learned this lesson about diversifying their services away from the traditional bank-and-trust formula. At a recent OffshoreAlert conference in Miami, I didn’t hear much worry about “Demise” in these jurisdictions. They appear to be thriving.

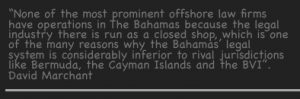

Unfortunately, we cannot begin to make these changes without a re-structuring of our legal profession, adamantly opposed by the backwoodsmen of our Bar Council and even our Deputy Attorney General. While our lawyers can provide excellent service in their chosen fields. it is simply impossible for them to gain the same international expertise–and connections–as attorneys who have spent years practicing in London, Edinborough, Dublin, or Toronto. So our law firms are passed over by financial heavyweight clients, losing millions of fee revenue that could support our GDP.

It’s easy to read the roster of several hundred partners of Applebys in Bermuda and Maples&Calder in Cayman (each with several foreign branches} and see the details of their extensive experience before moving offshore. We have few if any of this type. Apparently our Bar leaders fear they would take business away from Bahaman lawyers, whereas actually they would hire and train many juniors to rise in new fields. Foreign lawyers are now welcome only to handle a particular case or transaction and then take the first plane home.

In writing longer columns on this subject several years ago, I found there was a minority of local lawyers with a progressive view, who often felt oppressed by the dominant Old Guard. Even sophisticated QC Brian Moree seemed ambivalent about change. Perhaps only the imminent arrival of the WTO regime can compel salutary changes to open up our legal profession from its present chauvinism.

Mr. Coulson has had a long career in law, investment banking and private banking in New York, London, and Nassau, and now serves as director of several financial concerns and as a corporate financial consultant. He has recently released his autobiography, A Corkscrew Life: Adventures of a Travelling Financier.

Comments 1

As always a most excellent commentary on the painful decline of the once substantial offshore financial industry in the Bahamas.. Yes, you are so correct in pointing out the obvious deficiencies in the country’s legal practices, structure and services.. In so many cases the costs of legal services are excessive and are a detriment to seeking competent legal advise.. In addition, the over all costs of financial services being offered are not competitive with other similar jurisdictions.. High government fees and institutional administrative costs make other, lesser known, jurisdictions far more attractive.. These factors among others have cost the Bahamas significantly in loss of international business in a very competitive industry environment.. Regretfully, many former clients, over the past 18 years, have elected to move their financial affairs to other more competitive jurisdictions..

However, what is most troubling is the ever expanding extraterritorial reach of multilateral organizations like the EU and the OECD, who try to deliberately force their tax and compliance standards upon the Bahamas and other targeted offshore jurisdictions.. The Bahamas always is the subject of criticism and attacks by these groups claiming to promote “international best practices” and standards.. These provocations are nothing more than an outright and subversive attack upon our national sovereignty.. Let us not forget that, unlike our membership in the World Bank and IMF, we are not members of these oppressive organizations that continue to “black list” us as they do not approve of and find unacceptable our fiscal and regulatory policies.. Who are they to question the absolute right of how independent and sovereign nations elect to tax themselves and by what international right or divine power do they have to determine so called “best practices” and standards of compliance??

Perhaps the time has come for the Bahamas and other jurisdictions to stand up and protect their fundamental rights of self governance and individual sovereignty from such aggressive and oppressive attacks.. Grievances in concert with other such jurisdictions can be brought before international bodies like the World Court and the United Nations as to the deliberate aggression and attacks against the universal principle of National Sovereignty.. These multinational groups have a limited basis in law and act as both judge and jury in their provocative attacks upon small democratic elected countries who governments just capitulate to oppressive mandates and regulations that are deliberate forced upon them..

Enough is enough; we must join forces with other such jurisdictions to challenge the EU and the OECD as to their hard line political interfering and perhaps illegal political tactics in their aggressive attacks upon national sovereignty.. We can no longer afford to be the subject forced oppression by these non-elected, non-democratic, self-appointed multinational organizations who policies only are out to promote and support European collective Socialism..